Program Trading

Program Trading lets you define trading logic with code. When signals trigger, your strategy executes automatically without AI involvement.

Program Trading vs AI Trader

| Feature | AI Trader | Program Trading |

|---|---|---|

| Decision | AI model analyzes and decides | Code logic executes directly |

| Flexibility | High, handles complex scenarios | Medium, follows preset rules |

| Predictability | Low, AI may judge differently | High, same conditions = same results |

| Speed | Slower (waits for AI response) | Fast (direct code execution) |

| Best for | Complex market analysis | Clear rule-based strategies |

When to use which?

- AI Trader: When you need AI to analyze market conditions and handle ambiguous situations

- Program Trading: When you have clear trading rules and want fast, predictable execution

Workflow Overview

Market Data Collection → Signal Detection → Program Execution → Order Execution → AttributionCore Concepts

1. Signals and Signal Pools

Signals define "what conditions are worth watching":

- Example: CVD exceeds 1M, OI growth > 5%, Funding Rate > 0.01%

Signal Pools combine multiple signals for more reliable triggers:

- AND mode: All signals must be satisfied (stricter)

- OR mode: Any signal triggers (more sensitive)

The system uses edge triggering: triggers only once when conditions are first met.

2. Market Regime Detection

The system automatically identifies current market state:

| Regime | Meaning | Trading Suggestion |

|---|---|---|

| Breakout | Trend starting | Enter with trend |

| Continuation | Trend continuing | Hold or add |

| Exhaustion | Trend weakening | Consider taking profit |

| Absorption | Large orders absorbed | Wait and watch |

| Stop Hunt | Stop loss hunting | Wait for reversal |

| Trap | Bull/bear trap | Trade cautiously |

| Noise | No clear direction | Stay out |

Available Data in Strategies

Account Info

| Field | Description |

|---|---|

available_balance | Available balance |

total_equity | Total equity |

positions | Current positions (dict by symbol) |

open_orders | Pending orders |

recent_trades | Recent closed trades |

Trigger Info

| Field | Description |

|---|---|

trigger_symbol | Triggered symbol (e.g., BTC) |

trigger_type | Trigger type (signal / scheduled) |

signal_pool_name | Name of triggered signal pool |

triggered_signals | List of triggered signal details |

trigger_market_regime | Market regime at trigger time |

Environment Config

| Field | Description |

|---|---|

environment | Environment (testnet / mainnet) |

max_leverage | Maximum leverage limit |

default_leverage | Default leverage |

Available Functions

Get K-line Data

get_klines(symbol, period, count)- Purpose: Get historical candlesticks

- Parameters: Symbol, period (5m/15m/1h/4h/1d), count

- Returns: List of candles (time, OHLCV)

Get Technical Indicators

get_indicator(symbol, indicator, period)- Purpose: Get calculated technical indicators

- Parameters: Symbol, indicator name, period

Get Market Flow Data

get_flow(symbol, metric, period)- Purpose: Get market flow metrics

- Parameters: Symbol, metric type, time window

Get Market Regime

get_regime(symbol, period)- Purpose: Get current market state classification

- Returns: Regime type, confidence, direction, reason

Get Price

get_price(symbol) # Get latest price

get_price_change(symbol, period) # Get price change percentageBuilt-in Technical Indicators

Moving Averages

| Indicator | Description |

|---|---|

| MA5 / MA10 / MA20 | Simple Moving Average |

| EMA20 / EMA50 / EMA100 | Exponential Moving Average |

Momentum Indicators

| Indicator | Description |

|---|---|

| RSI7 / RSI14 | Relative Strength Index |

| MACD | Moving Average Convergence Divergence (returns macd, signal, histogram) |

| STOCH | Stochastic Oscillator (returns K, D values) |

Volatility Indicators

| Indicator | Description |

|---|---|

| BOLL | Bollinger Bands (returns upper, middle, lower) |

| ATR14 | Average True Range |

Volume Indicators

| Indicator | Description |

|---|---|

| OBV | On-Balance Volume |

| VWAP | Volume Weighted Average Price |

Market Flow Metrics

| Metric | Description | Use Case |

|---|---|---|

| CVD | Cumulative Volume Delta | Buy/sell pressure comparison |

| OI_DELTA | Open Interest change rate | Capital flow direction |

| TAKER | Taker buy/sell ratio | Market sentiment |

| DEPTH | Order book depth ratio | Support/resistance strength |

| IMBALANCE | Order book imbalance | Short-term direction |

| FUNDING | Funding rate | Long/short sentiment |

Decision Output

Your strategy must return a Decision object:

| Field | Required | Description |

|---|---|---|

operation | Yes | Operation type: buy / sell / close / hold |

symbol | Yes | Trading pair |

reason | Yes | Decision reasoning |

target_portion_of_balance | For buy/sell | Balance portion to use (0.1-1.0) |

leverage | For buy/sell | Leverage multiplier |

take_profit_price | No | Take profit price |

stop_loss_price | No | Stop loss price |

Step-by-Step Guide

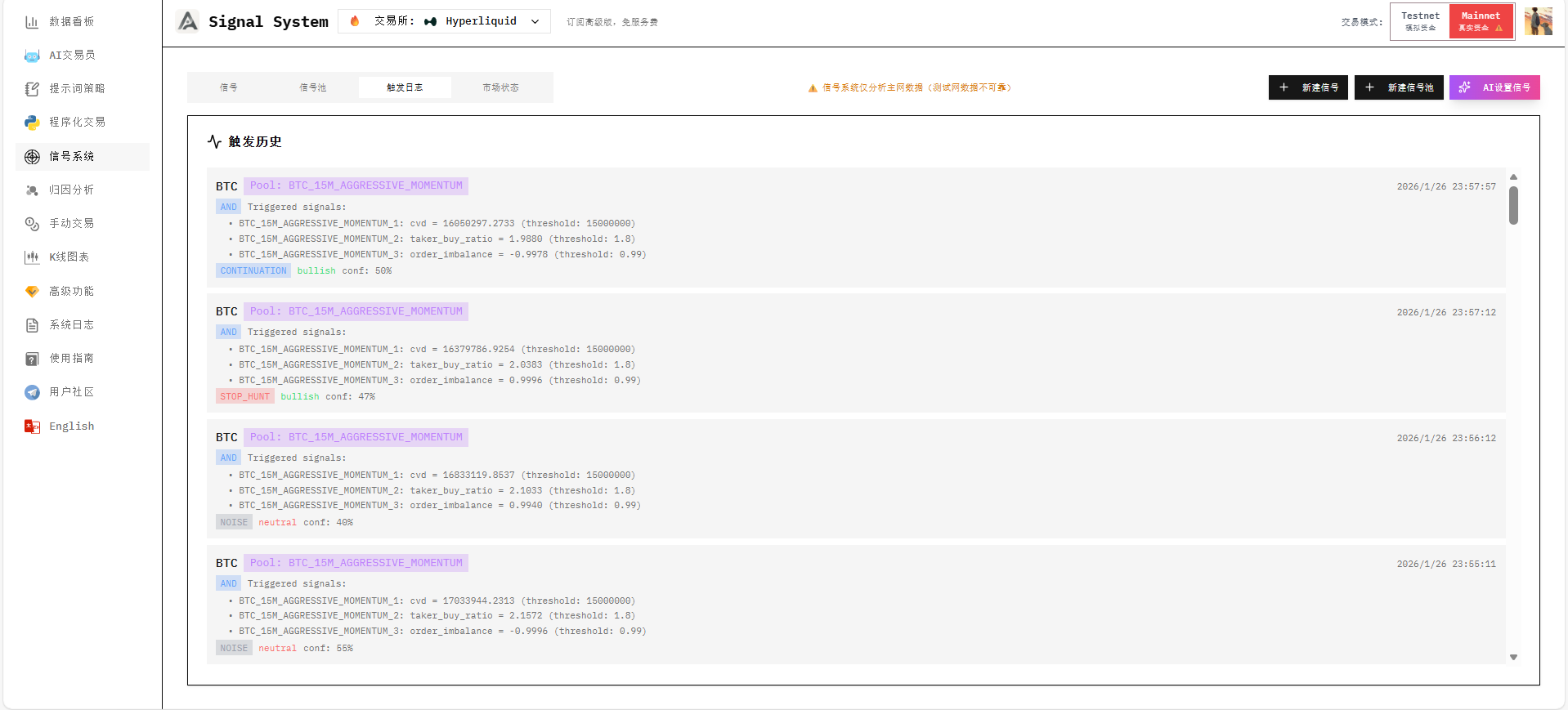

Step 1: Configure Signals (Optional)

If you want signal-triggered programs, first create signals and signal pools in Signal Pools.

Common monitoring metrics:

- CVD: Cumulative Volume Delta - buy/sell pressure

- OI Change: Open Interest change - capital flow

- Funding Rate: Long/short sentiment indicator

- Order Book Depth: Buy/sell pressure comparison

Step 2: Create AI Trader Account

- Go to Account Management page

- Create new account, select "AI" type

- Configure AI model and API Key

- Enter Hyperliquid private key (use testnet first)

- Enable "Auto Trading" switch

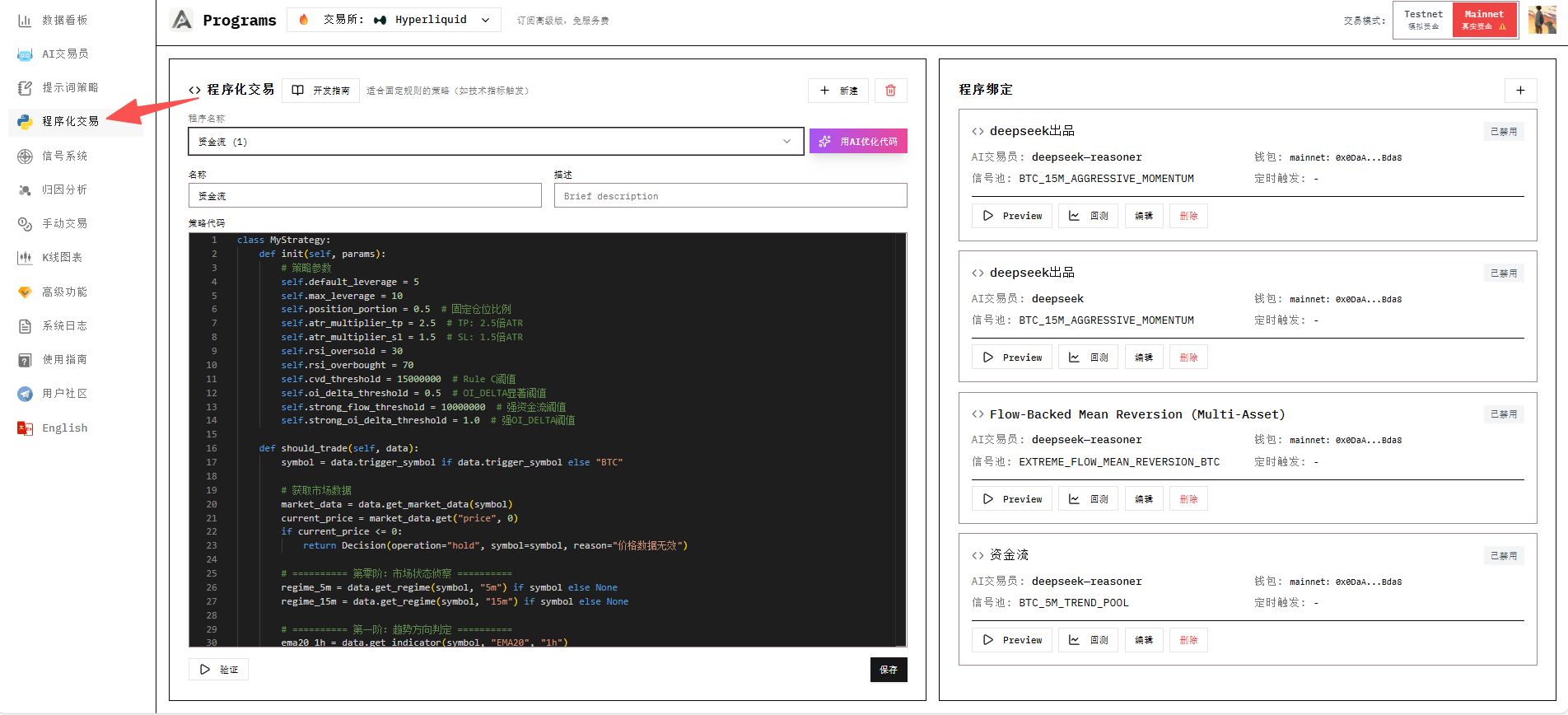

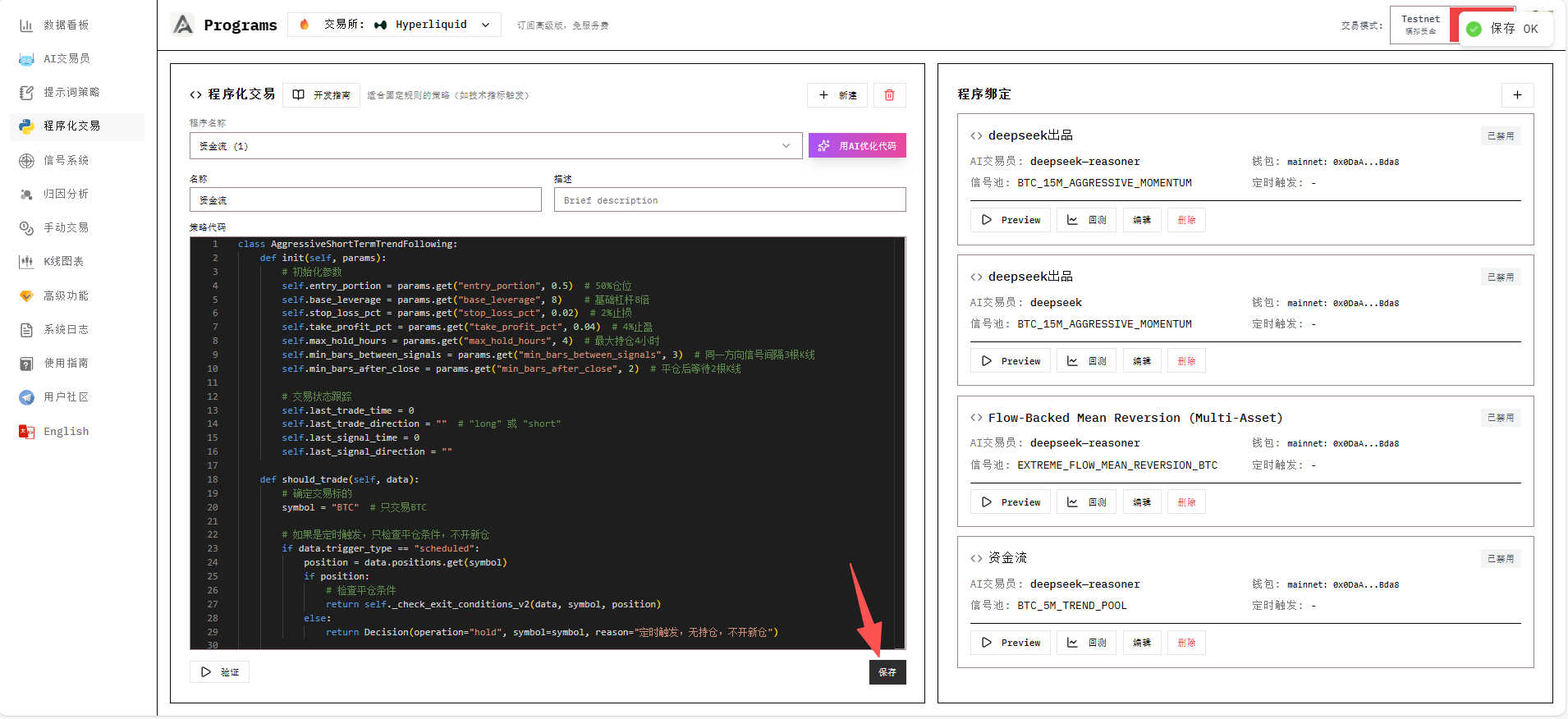

Step 3: Create Trading Program

- Go to Program Management page

- Click AI Code Assistant, describe your strategy in natural language

- AI generates and tests code, outputs to editor when passed

- Click Save

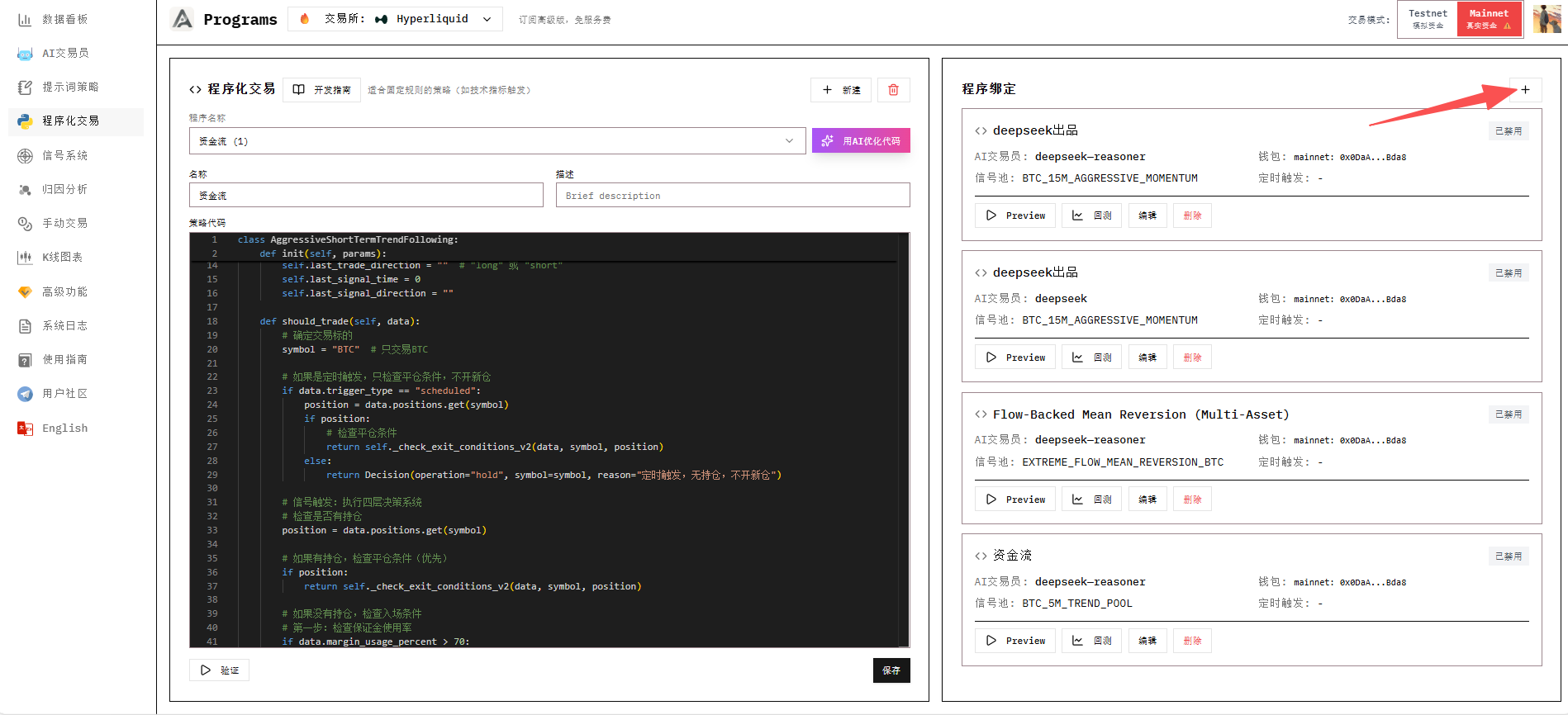

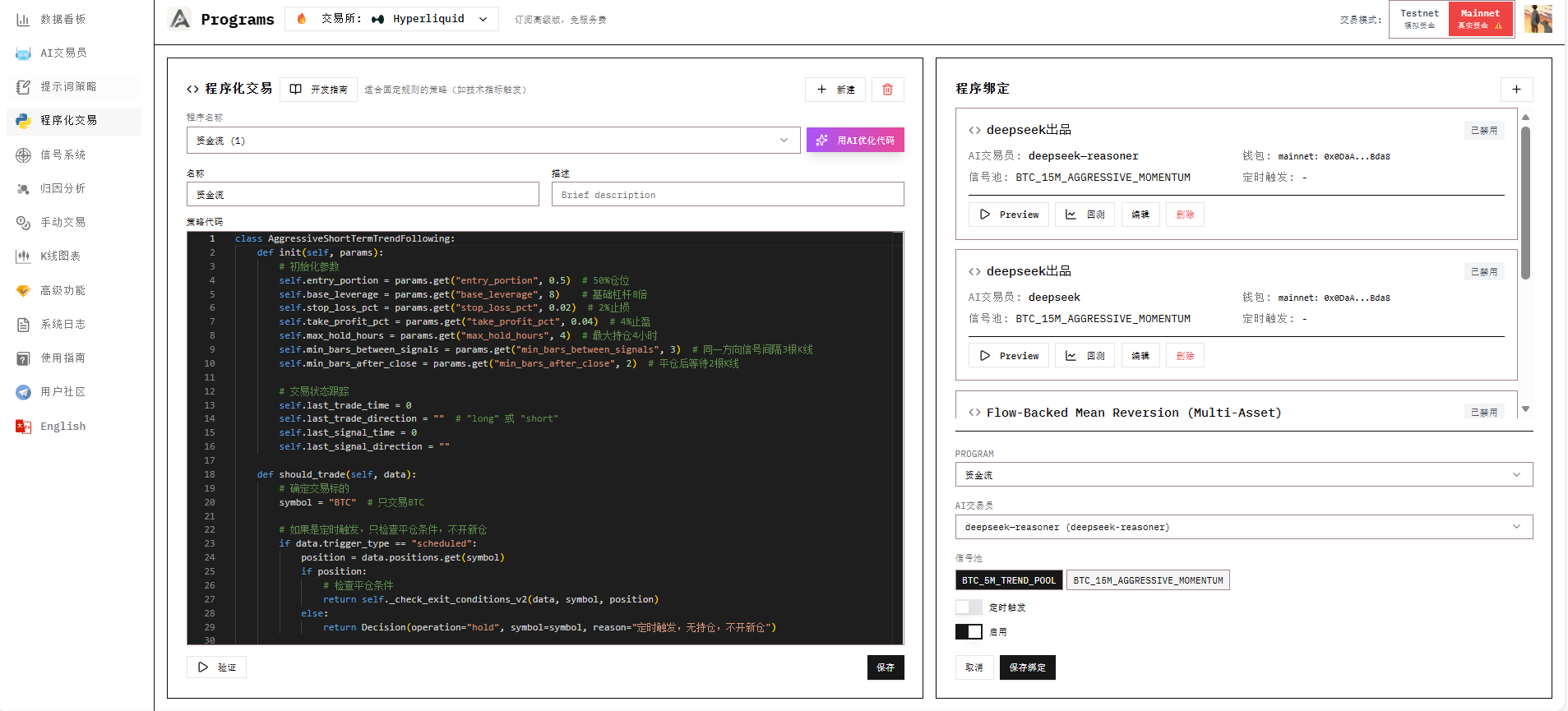

Step 4: Bind Program to Account

- Select the AI Trader account to bind

- Check the signal pools to trigger on

- Set scheduled trigger interval (optional)

- Click Save Binding

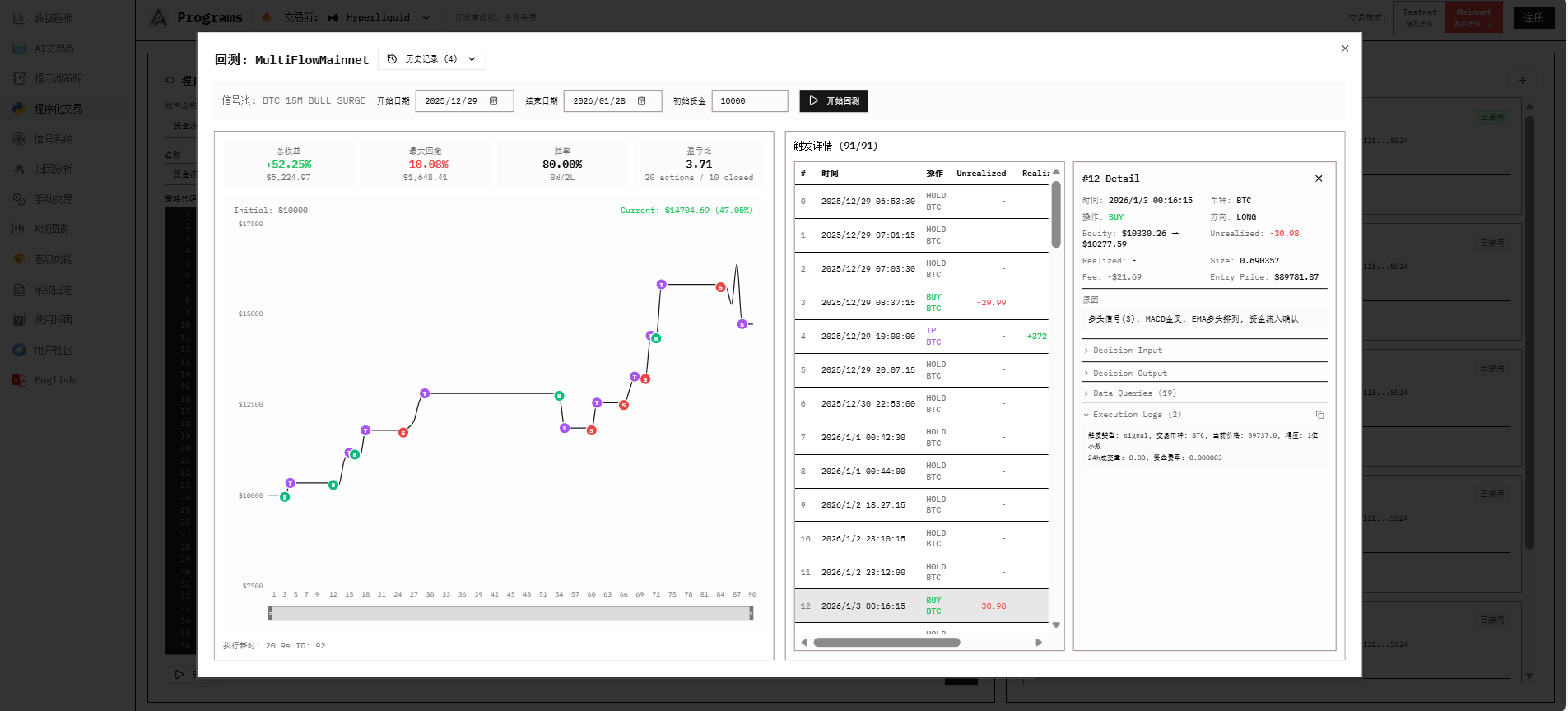

Backtesting

After binding, you can backtest your program to validate it.

Backtest Types

| Type | Purpose | Description |

|---|---|---|

| Program Backtest | Validate strategy code | Simulate strategy with historical K-lines |

| Signal Backtest | Validate signal effectiveness | Check historical trigger patterns |

How Backtesting Works

Load historical K-line data

↓

Iterate from candle #50 onwards

↓

Build MarketData for each candle (only sees current and past data)

↓

Execute strategy code, get Decision

↓

Simulate trade execution (calculate fees, update virtual positions)

↓

Output backtest resultsData Requirements

Backtesting requires historical data. If the system wasn't running during a period, there's no market flow data for that time, making backtest results inaccurate. Keep the system running 24/7 or deploy to a server.

Backtest Result Metrics

| Metric | Description |

|---|---|

| Total Trades | Number of open/close trades |

| Win Rate | Percentage of profitable trades |

| Total PnL | Cumulative profit/loss |

| Max Drawdown | Maximum equity decline from peak |

| Sharpe Ratio | Risk-adjusted return |

| Equity Curve | Account value over time |

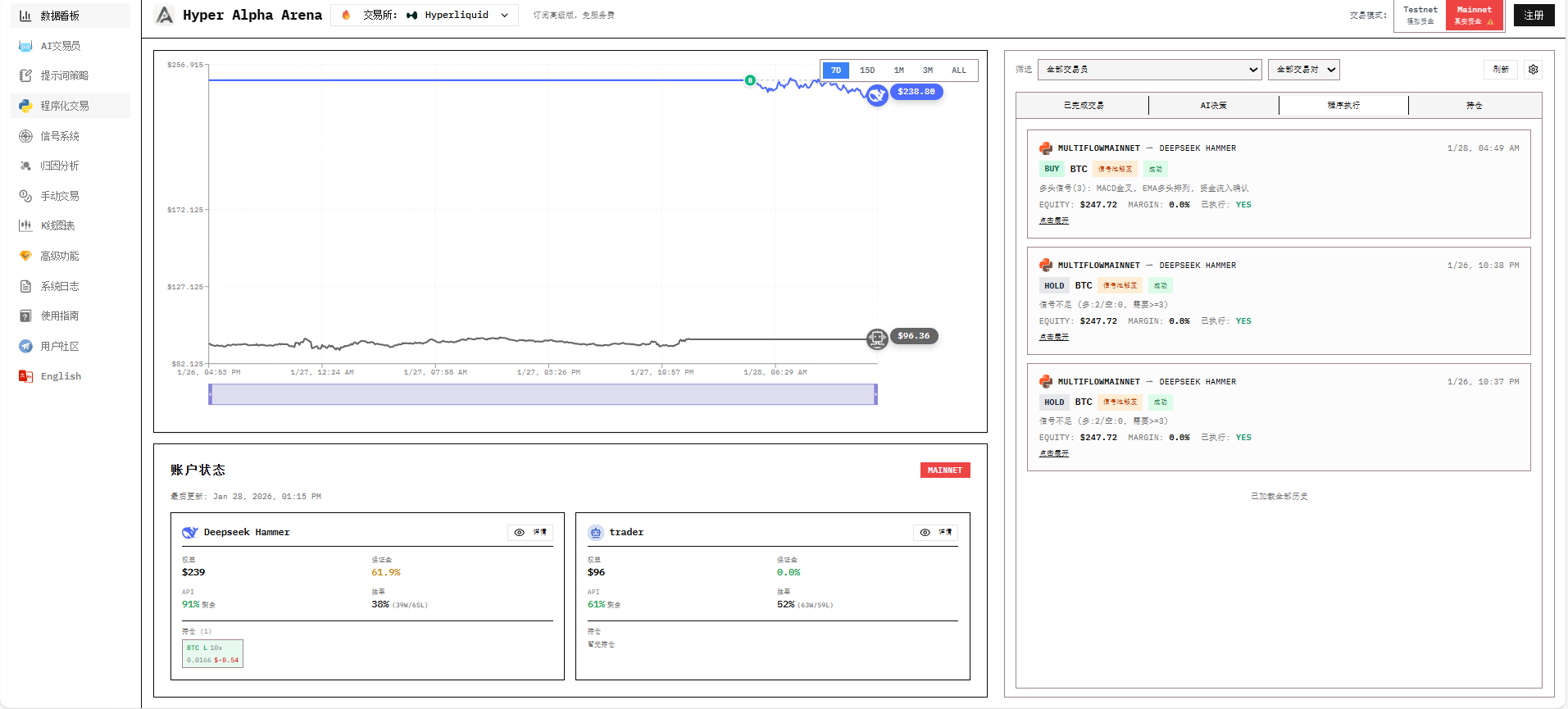

Monitoring

View Execution Logs

Check detailed trigger records in the Signal System page:

View Positions and Assets

Monitor real-time positions, PnL, and asset curves in the Dashboard:

Best Practices

- Test before live trading: Validate all strategies on testnet first

- Control position size: Don't use too large a portion per trade

- Use reasonable leverage: Choose leverage based on strategy characteristics

- Regular review: Analyze strategy performance through execution logs

- Diversify risk: Run multiple accounts with different strategies

Next Steps

- Dashboard & Monitoring - Monitor trading performance

- FAQ - Common questions and solutions